The Deferred Sales Trust (DST)

What is it, when would I use it, and why is it better than other options?

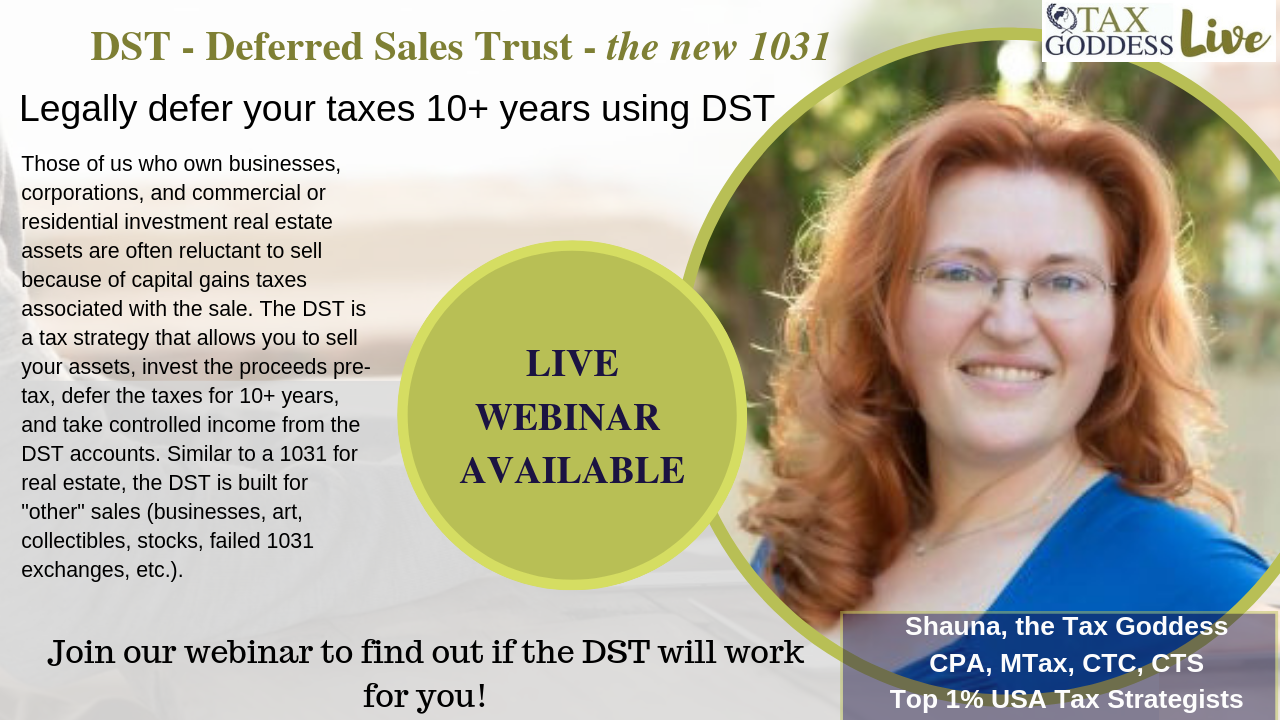

Those of us who own businesses, corporations, stocks, collectibles, and commercial or residential real estate assets are often reluctant to sell because of the massive amount of taxes associated with the tax.

The DST is a gain deferral program that allows you to sell the asset now, receive the proceeds into a trust, invest 100% of the proceeds (before you pay any taxes!), and take distributions as a later date (which you control, can change, and can plan for the “later” tax consequences).

There are many more ways that the DST can be a great fit for your sale. As each case is different, we suggest that you work with one of our professional team members to discuss your case and ensure that the DST is the right fit for your needs.